UC Zero Interest Program (ZIP)

Eligible program participant must be a full-time university appointee (Academic Senate or Senior Management Group) who is designated by the hiring dean and approved by the Provost. The offer to utilize a ZIP loan is only valid to use within 4 years from appointment date.

ZIP Loan Overview

ZIP loans may not be used toward the purchase of home in University Hills. Following are loan parameters:

| Description | |

|---|---|

| Interest Rate: | 0% |

| Payment: | No monthly payment |

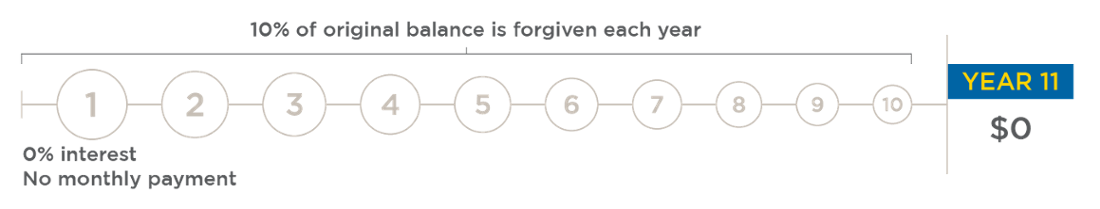

| Loan Term: | Approximately 11 years depending on the funding date. |

| Due Date: | End of the loan term or upon separation from employment. |

| Loan Forgiveness: | Ten (10) percent of the original principal balance of the ZIP loan may be forgiven each year. Additional requirements. |

| Repayment: | Outstanding principal balance (original principal balance, less any forgiven amounts) is fully due and payable and is considered a “balloon payment” upon the due date. |

| Loan-to-Value Ratio: | ZIP loan can be combined with a primary loan, allowing program participants to finance up to 95% of a home purchase. |

| Lien Position: | Second or Third Can be subordinate to an outside loan, subject to the program (+ standard fees) and primary lender’s guidelines. |

ZIP Program Requirements

![]()

Property must be within a reasonable distance of participant’s work location.

![]()

Participant must not have owned a primary residence within the prior 12 months near work location.

![]()

ZIP loans are available only for a single-family residence (5 acreage limit) or a condominium outside of University Hills.

![]()

Property must be the principal place of residence for the primary participant for the term of the loan.

![]()

Loan may not be used for construction financing.

![]()

Loan defaults if the university does not receive the outstanding principal balance by the ninetieth (90th) day after the due date, or within a certain period following the acceleration date, as applicable.

Forgivable Feature

Ten (10) percent of the original principal balance of the ZIP loan will be forgiven each year, with the annual written endorsement of the department chair or equivalent designee, provided that the participant:

- continues to be employed by the nominating university campus as an eligible participant, as defined in the program guidelines;

- is in good standing; and

- is not in default on any term or condition of a program loan.

Loan forgiveness will be reported as taxable income in the year forgiven on a W-2 form and is subject to standard withholding requirements.

Loan Acceleration

All program loans are condition of employment loans. The ZIP loan can be declared due and payable before the due date for a number of reasons, such as if the designated ZIP loan participant (the "Primary Borrower") separates (e.g., retirement, transfer to another university, voluntary separation, involuntary termination, or death) from the University of California, becomes ineligible under the program guidelines, or if the property securing the loan is sold or transferred.

Important Considerations

- ZIP loan can only be carried by the primary borrower and is not assumable by another borrower or survivor.

- Upon the due date, any outstanding principal balance (original principal balance, less any forgiven amounts) is due and payable by the Zip loan participant (the "Primary Borrower") and is not contingent upon the sale price or fair market value of the house, or any other factor.

- ZIP loan's balloon repayment feature makes it a non-qualified mortgage.

- A Qualified Mortgage (QM loan), defined by the Consumer Financial Protection Bureau (CFPB), is a loan having certain features that are thought to make it more likely for a borrower to be able to repay it. Because there is a potential for a larger than usual one-time payment at the end of the loan term (balloon payment), this type of loan does not qualify as a QM loan.

- Annual forgiveness process begins in July, so loans that fund from July to December will be reviewed for forgiveness during the forgiveness processing period the year after funding.

- Loan terms vary between 10-11 years depending on the funding date. For example, the first forgiveness period for a loan that funded in July 2022 would start in July 2023.

- Loan forgiveness will be reported as taxable income in the year forgiven on a W-2 form and is subject to standard withholding requirements.

- ZIP loan is a below market-rate loan since the interest rate of "zero" is below the Applicable Federal Rate (AFR).

- Below market-rate loans are subject to annual imputed interest income.

- Imputed interest income will be reported as taxable income on a W-2 form and is subject to standard withholding requirements.

- Participants should consult with their tax advisor if they have any questions concerning their tax situation.