UC Mortgage Origination Program (MOP)

Full-time university employees who are members of the Academic Senate or Senior Management Group (SMG) employees are eligible.

MOP Loan Overview

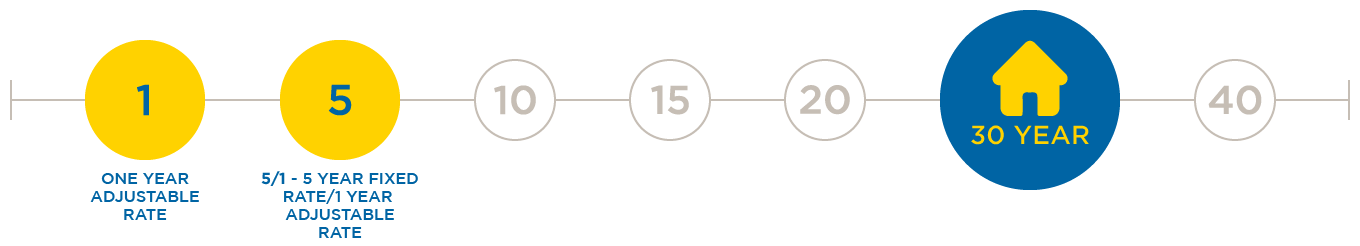

MOP provides first deed of trust loans with a one-year adjustable rate based upon an internal university index. There are two types of MOP loan options: Standard MOP and 5/1 MOP.

| Standard MOP | 5/1 MOP | |

|---|---|---|

| Fixed Rate Period: | 1 year | 5 years |

| Qualifying Interest Rate: | Standard MOP rate at time of loan commitment | 5/1 MOP rate at time of loan commitment |

| Annual Interest Rate Adjustment: | Capped at +/- 1%, subject to min. and max rates |

|

| Maximum Loan Term: | 30 years | 30 years |

| Minimum Interest Rate: | 3.25% | 3.25% |

| Maximum Interest Rate: | 10% over the initial interest rate | 10% over the initial interest rate |

| Maximum Payment-to-Income Ratio: | 40% | 40% |

| Maximum Overall Debt-to-Income Ratio: | 48% | 48% |

| Private Mortgage Insurance (PMI): | No PMI required | No PMI required |

| Lender Fees: | No points or lender fees | No points or lender fees |

| Maximum Loan-to-Value Ratio: |

For loans up to $2,370,000*, a 10% downpayment is required (90% LTV)

For loans over $2,370,000*, a 20% downpayment is required (80% LTV) *Loans in excess of $2,370,000 require additional approvals |

|

MOP Program Requirements

![]()

Property must be within a reasonable distance of participant’s work location.

![]()

Participant must not have owned a primary residence within the prior 12 months near work location.

![]()

MOP loans are available only for a single-family residence (5 acreage limit) or a condominium.

![]()

Property must be the principal place of residence for the primary participant for the term of the loan.

![]()

Loan may not be used for construction financing.

![]()

Repayment in full is required six months after separation from the university (unless for university retirement or disability).